Income Tax Registration Process | Step by step guides | How to do 2024

Last updated on November 29th, 2023 at 07:36 am

Income Tax Registration Process | Step by step guides | How to do?

Hi Readers, as we know that every year an income tax return needs to be filed by an individual or a company to submit their annual income statement to the government. Now the question arises in the mind of an individual whether to file or not an income tax return. So the answer to this is it’s more of a responsibility as a citizen of the country to file income tax returns timely and accurately. So here we are going to discuss on Income Tax Registration Process, details are given below.

The government has framed tax slabs to determine the rate of tax one needs to pay against their income or rather we can say slabs to determine how much tax one owe to the government. The filing income tax return also helps us to claim refund of tax deducted against the salaries or investments made. (Details about the same will be soon uploaded).

Let us go through the Tax slab for a better understanding:-

| Income Slab | Individuals below the age of 60 years |

| Upto Rs 2.5 lakhs | Nil |

| Rs 2.5 lakhs to Rs 5.00 lakhs | 5% |

| Rs 5.00 lakhs to Rs 10.00 lakhs | 20% |

| >Rs 10.00 lakhs | 30% |

However, people avoid income tax filing due to the filing agents charging thousands of rupees for even a nil return. To help you come out of this trouble techiequality has taken up this initiative to teach you the whole return filing process for individuals at zero cost. What is required is just a few hours of your time and you get your return filed. Before stepping into return filing you need to get yourself registered as a taxpayer. Oh, don’t panic we are here to solve this issue. Today we will show you how you can register yourself in just a few minutes to become eligible to file an income tax return.

Step-by-step guide of Income Tax Registration Process:

Let’s go step by step to check the whole procedure:-

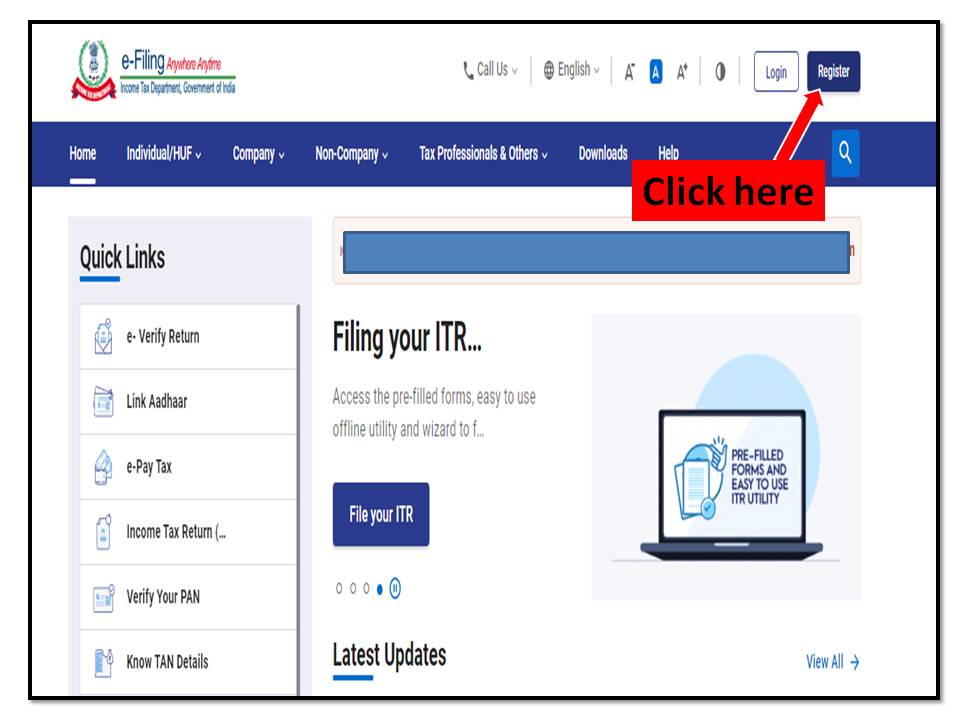

Step 1:- First we need to open the Efiling portal of income tax. Link attached https://www.incometax.gov.in/iec/foportal

Step 2:-

After clicking on the above link income tax page will be displayed where you need to click on register, to begin with the registration procedure. The image is attached for easy reference.

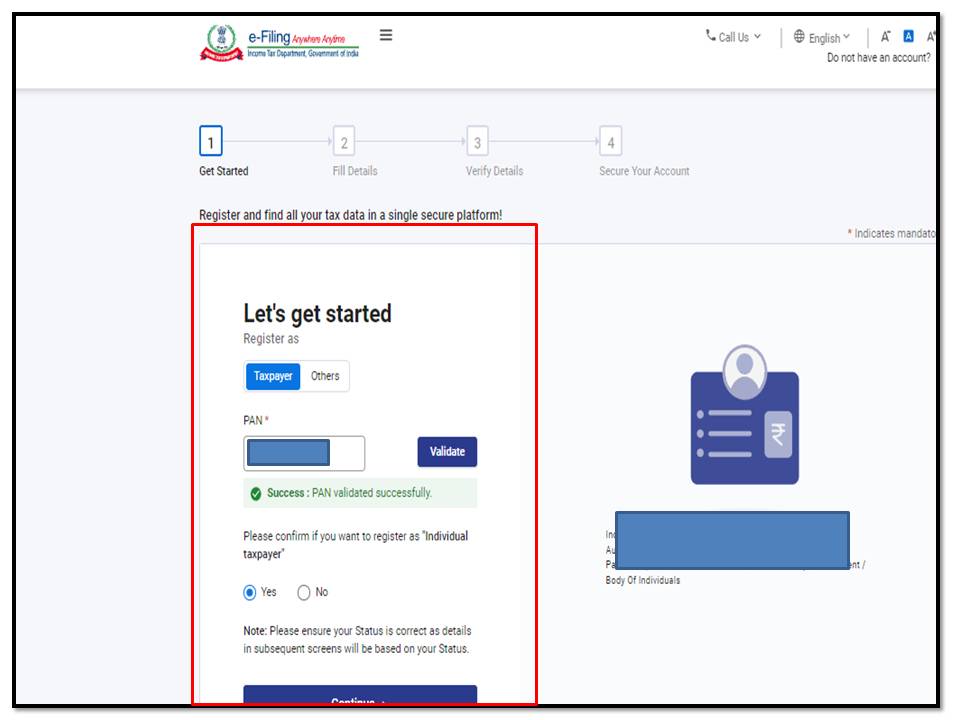

Step 3:-

When you click on register home page will be displayed with four-step registration. Here you need to add your PAN number and then select taxpayer to validate it and click on continue.

Image is attached for easy reference.

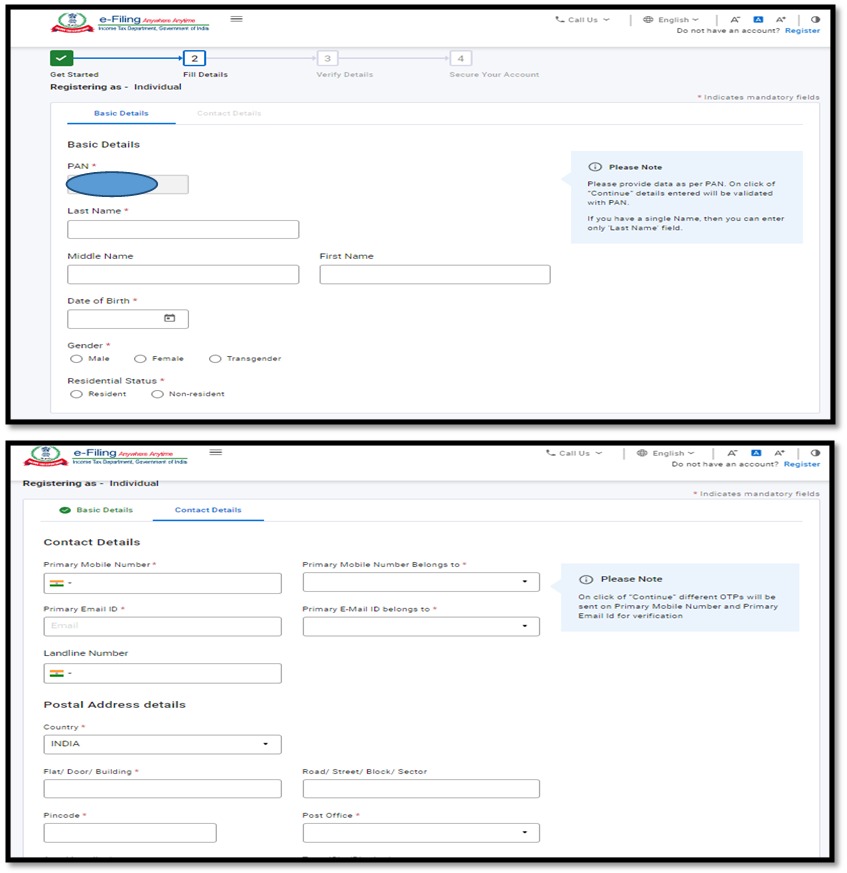

Step 4:-

Now fill in all your personal details. (Here they ask for very minimum details like Name,Address , Date of Birth , and Residency)

After filling in all the details you will be required to verify with an OTP which you will receive on your mail id as well as your phone number. Insert both of them and then click on continue. After which you will be directed to choose your PASSWORD which should be at least 8 to 16 characters (the password should include Capital letters, Small letters, Numbers, and Symbols). Save it for future reference. Then all the details will be displayed which you need to verify and confirm. In case of any changes, you have the edit option there to modify the same.

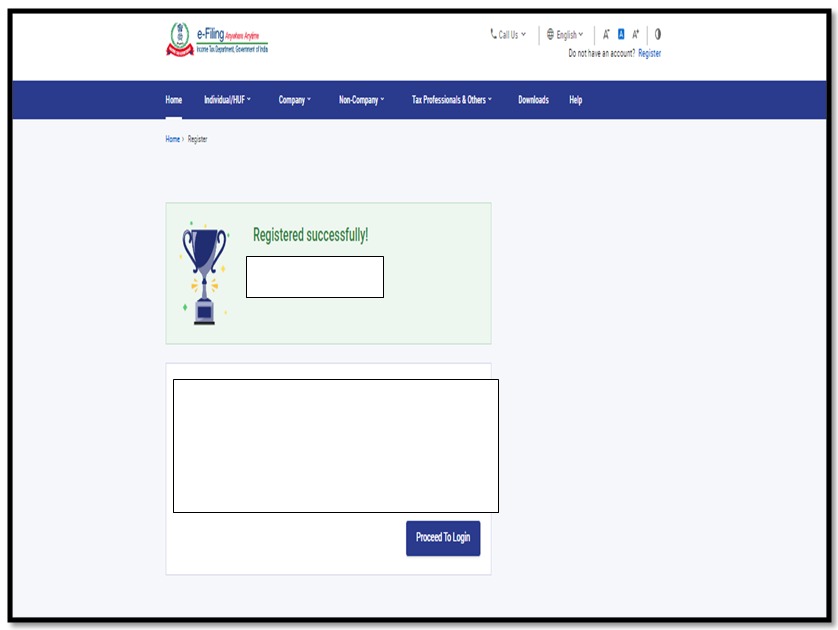

After completing all the above steps you will get a popup message of successful registration.

Thus this completes your registration on the income tax site. Then you can login using your ID and Password.

Our next article will be on how cans an individual file an Income Tax Return by self. Till then keep learning

Disclaimer note: Source reference: Income Tax Dept. Govt. of India. (https://www.incometax.gov.in/iec/foportal)

The income tax slab is only for reference purposes. The slab may be changed from time to time by govt. of India, so kindly visit the official website of govt. to know the exact & accurate value of the tax slab. The author is not responsible for any loss at your end.

Thank you for reading…Keep visiting Techiequality.Com

Popular Post