Professional tax return filing online | West Bengal professional tax return 2024

Last updated on November 29th, 2023 at 07:35 am

Professional tax return filing online | West Bengal professional tax return:

Hi Readers, Now Professional tax return filing is in your hands no more persual to an expert to file a return. Just you need to follow a few simple steps, and you are done.

In our previous post, we understood all about Ptax. What is it, who is eligible for it, when to pay, what are the slabs, and How to pay online?

In this post, we will learn the whole procedure to file a Professional tax return filing in online. Professional Tax is filed annually. As per West Bengal State, a Professional Tax return needs to be filed annually on 30th April of the respective year.

Filing returns after the due date will attract a fine @Rs 200/- in the 1st month of default. And Rs 100/- for each subsequent month thereon will be levied on individuals.

Now, let’s start with the procedure of filing a return:-

(Images of each step are attached for easy reference)

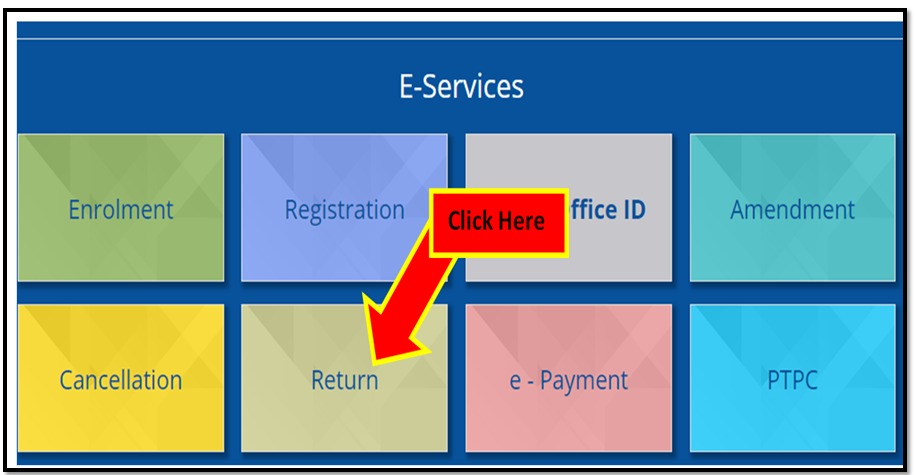

Step 1-

Firstly login into https://wbprofessiontax.gov.in/

Then under E-services go to the Return option as shown below

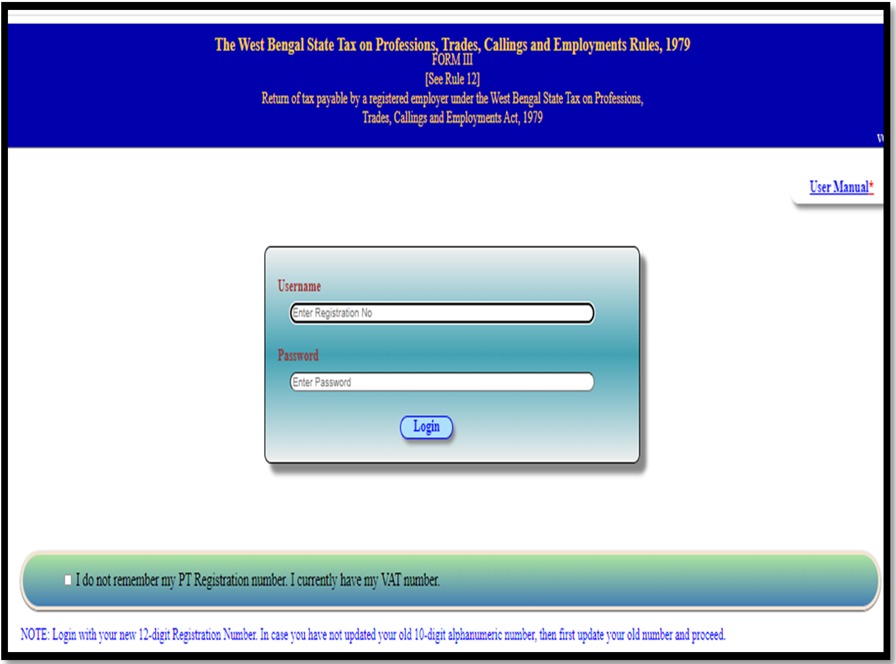

Then a login page will be displayed as shown below:-

Step 2:-

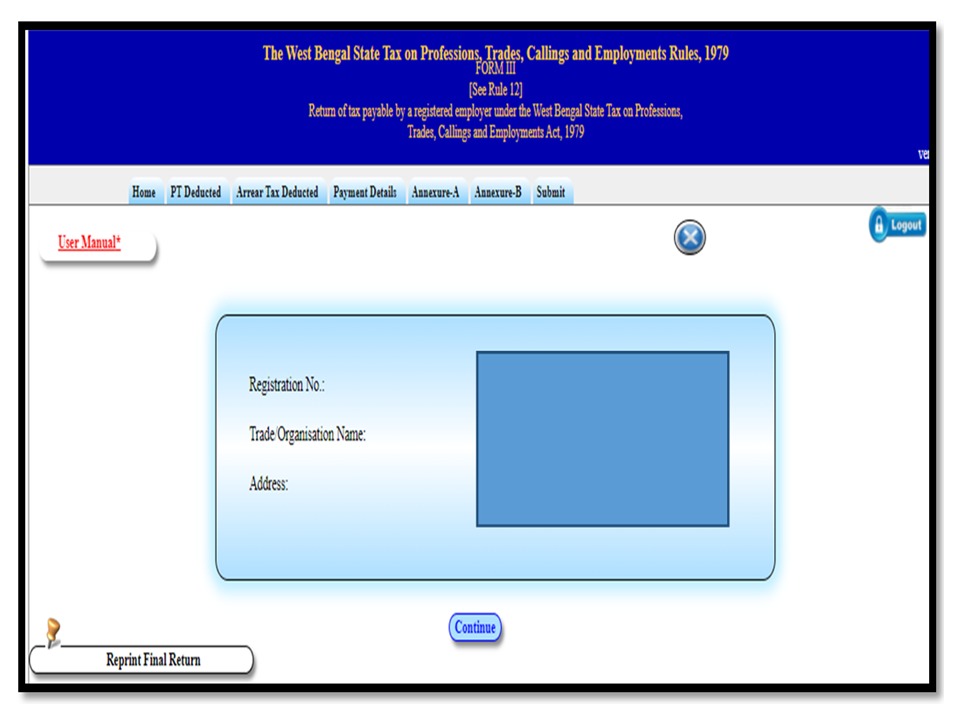

Login in using your User name and Password . After which your home page with all the details like Registration number, Trade name, and Address will be displayed (Image attached ).

Step 3:-

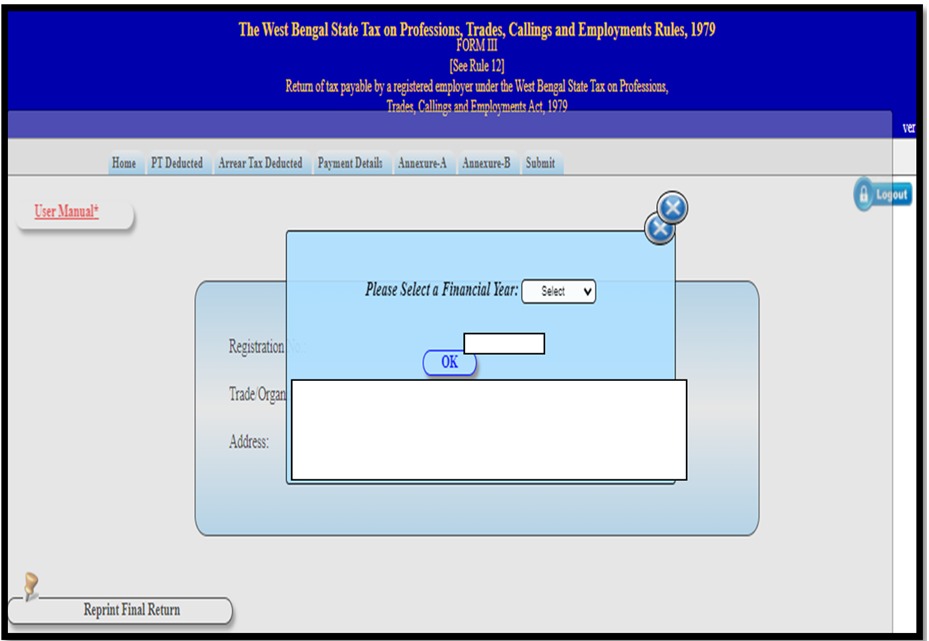

Select the year for which you need to file the return (remember you need to select the financial year). Once the financial year is selected PT Deducted page will be displayed.

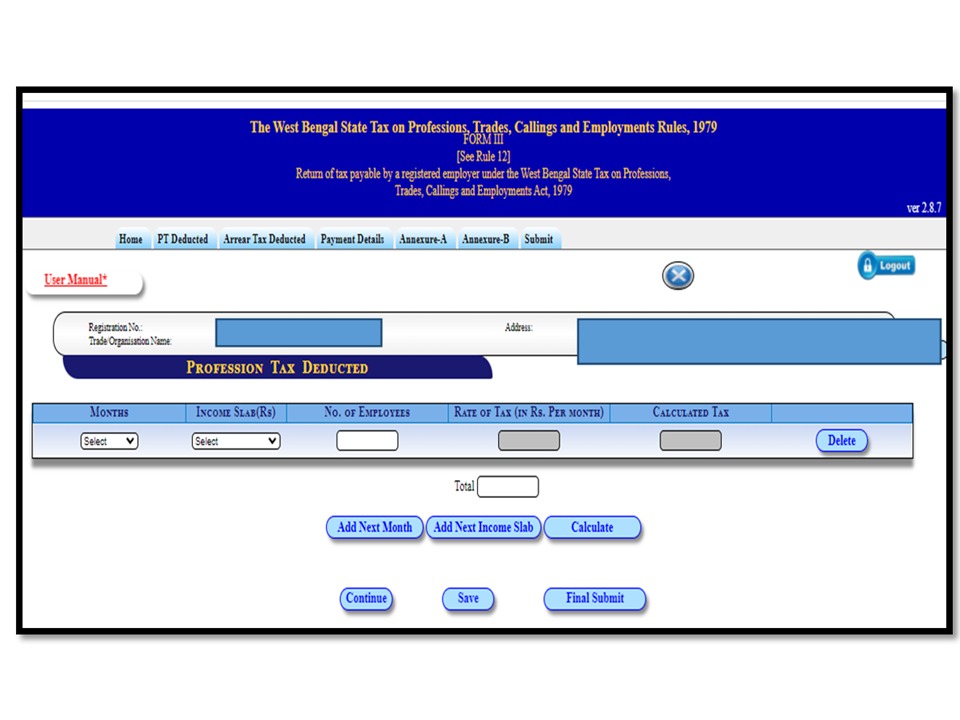

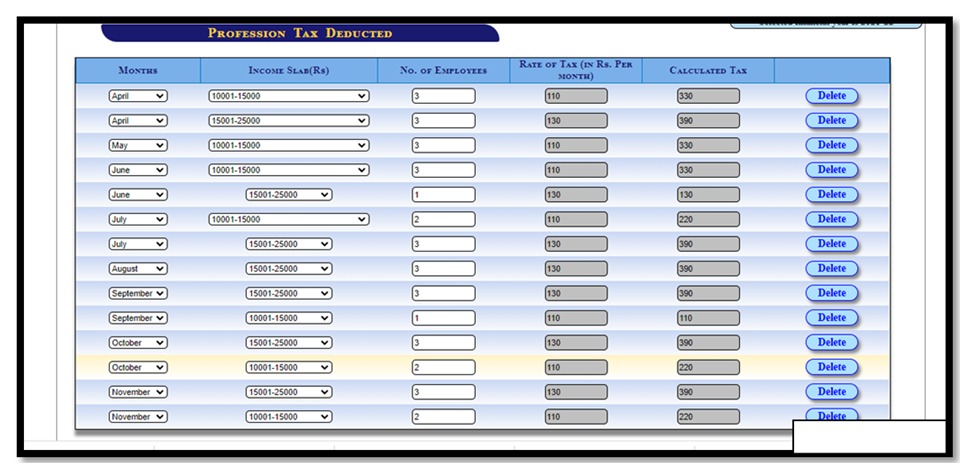

Step 4:-

PTAX Deducted page will be displayed where you need to fill in all the details -Month of deduction, Select the slab(which is present in the dropdown ), and Number of employees (Note:-Different slabs to be selected for each month )Ready image attached for easy reference.

Slabs for West Bengal are as follows:-

| Monthly Salary | Amount of tax to be deducted |

| Upto Rs 10,000/- | Nil |

| Rs 10,0001 to Rs 15,000/- | Rs 110 |

| Rs 15,0001 to Rs 25,000/- | Rs 130 |

| Rs 25,0001 to Rs 40,000/- | Rs 150 |

| Above Rs 40,001/- | Rs 200 |

After filling in all the details on the professional Tax deducted page you need to click on save and continue to proceed further.

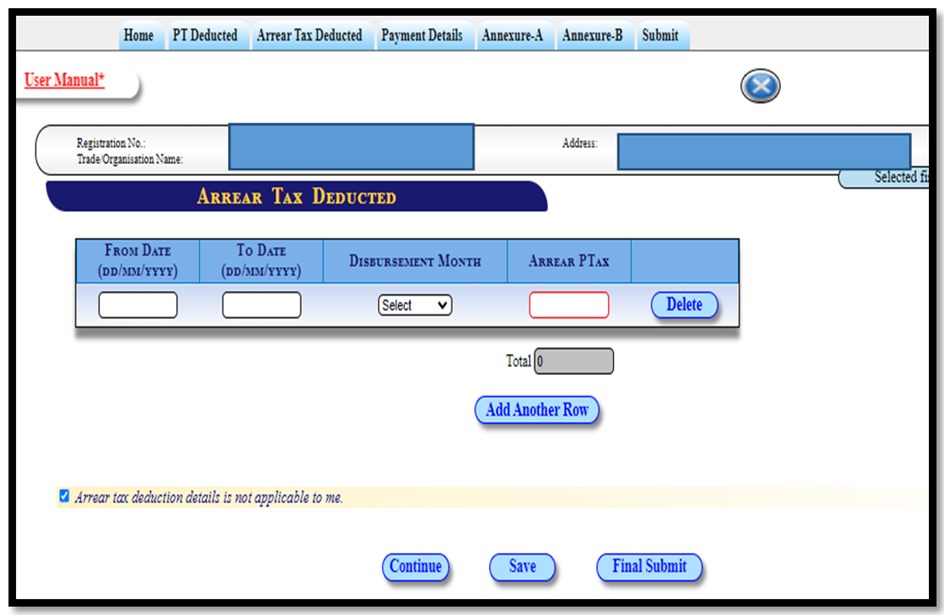

Step5:-

After clicking continue you will be taken to the next page Arrear Tax Deducted(here you need to fill in details of any tax arrears previously. If nothing then simply click on the check box of Arrear tax deduction not applicable to me and click save and continue)

Step 6:-

Next, you will be taken to the payment page where details of monthly payments made by you will be displayed (You can check the procedure to pay Ptax online.).

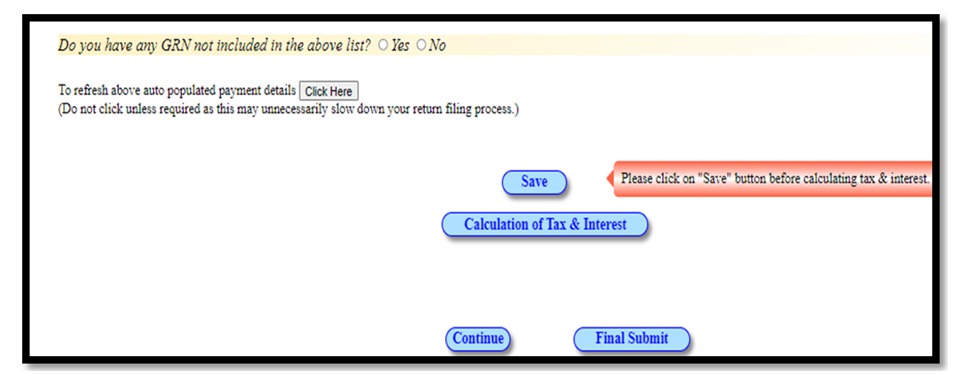

All the challan details with month and amount will be displayed on this page, which you can cross verify and confirm. If you find any challan missing you have a check box there where they ask you if you have any GRN missing you can choose between yes and no accordingly.

Then go to Calculation of Tax and interest, this option helps you to auto calculate the tax and interest amount. If there’s a shortfall you will be asked to pay challan against the same which after payment takes 3 days minimum to get added to the page. After this click on the calculation of Tax and Interest where you will be taken to the final computation page.

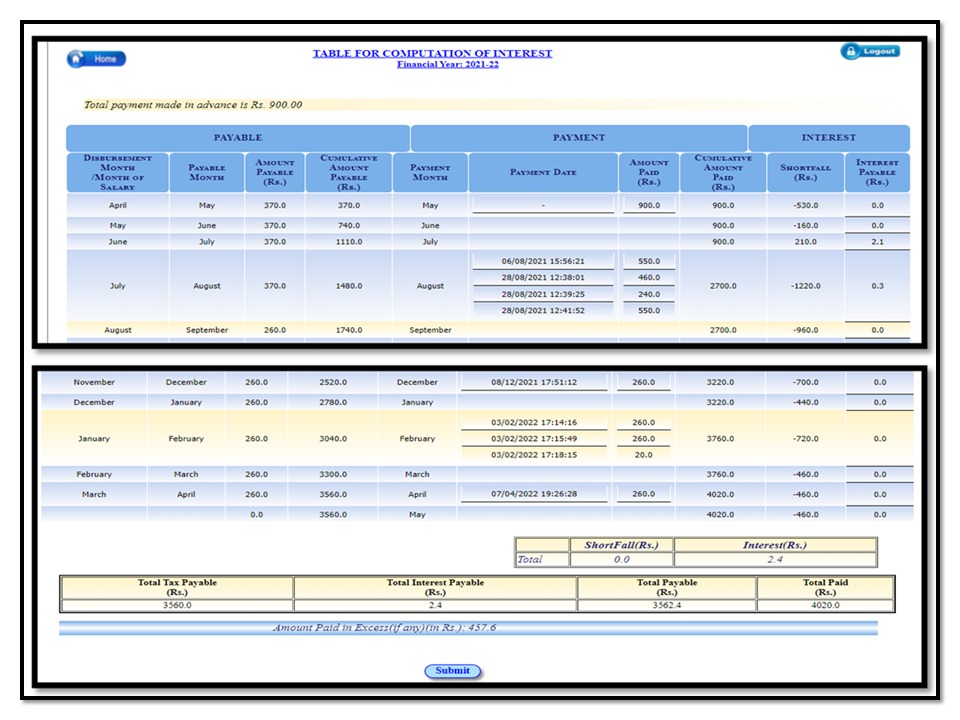

After final completion of the whole procedure, you will be presented with the table which displays the computation of payment and interest.

Check and verify the same and then finally submit it. After submission, an acknowledgment page will be displayed. which you need to download the pdf file where you will get a zip file with payment challan and acknowledgment slip.

You need to send hardcopies of the same to the office of professional tax in your respective charge. and submit the same. Also, carry two copies of the document to get a stamp signed by the respective authority for future reference.

Disclaimer note: Source reference: Professional tax, West Bengal-https://wbprofessiontax.gov.in/.

Please visit and ensure the ptax slab, method, or process through source reference / official website. The author is not responsible for any loss at your end.

Thank you for reading…Keep visiting Techiequality.Com

Popular Post